Inspired by insights from Harvard Business Review, this piece explores how leadership must evolve to balance profit with purpose, and growth with equity.

Over the past several decades, the global economy has grown enormously — yet the benefits of that growth have not been evenly shared. As highlighted by Harvard Business Review, inequality in both wealth and income is widening, with a disproportionate share of gains flowing to the wealthiest households. Meanwhile, working-class individuals increasingly feel left behind, as their wages stagnate despite rising productivity and corporate profits.

Researchers like Gary Hamel and Michele Zanini argue that one of the underlying causes lies not just in economics, but in how organizations are managed. The traditional bureaucratic model — characterized by rigid hierarchies and limited employee autonomy — often stifles creativity, engagement, and innovation. This system not only reduces motivation at the individual level but also prevents economies from fully leveraging human potential.

Their proposed solution? Radical management innovation and employee empowerment. By redesigning workplaces to prioritize trust, inclusion, and skill development, organizations can unlock greater adaptability and drive more equitable economic growth.

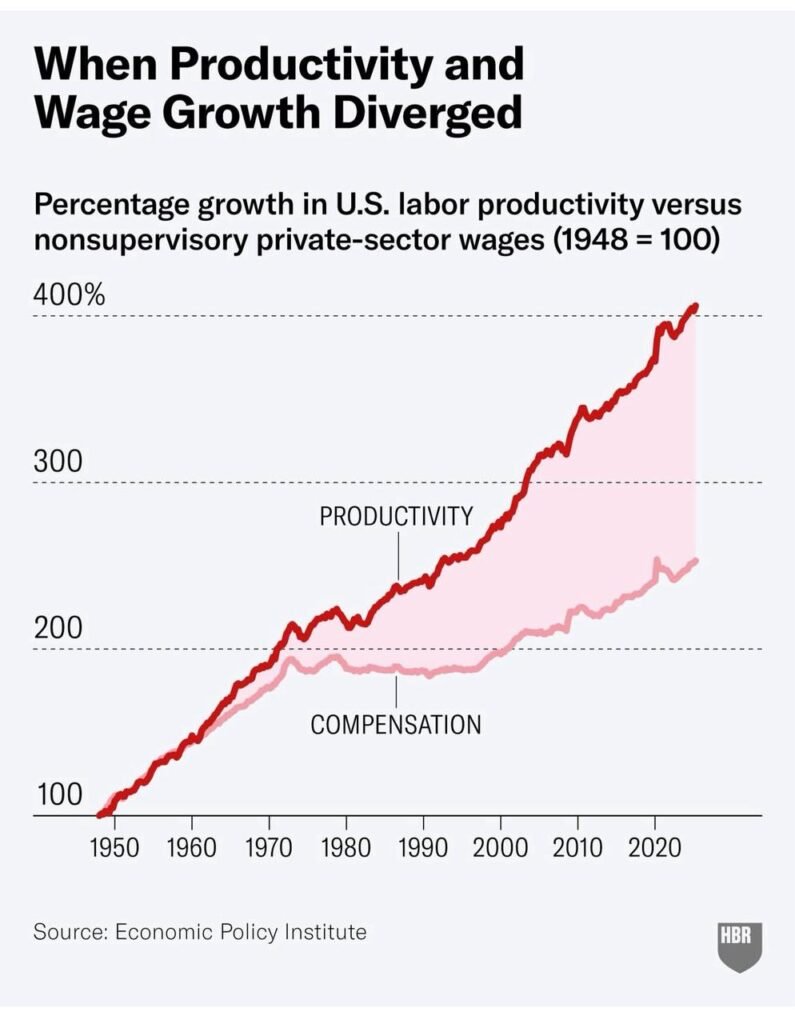

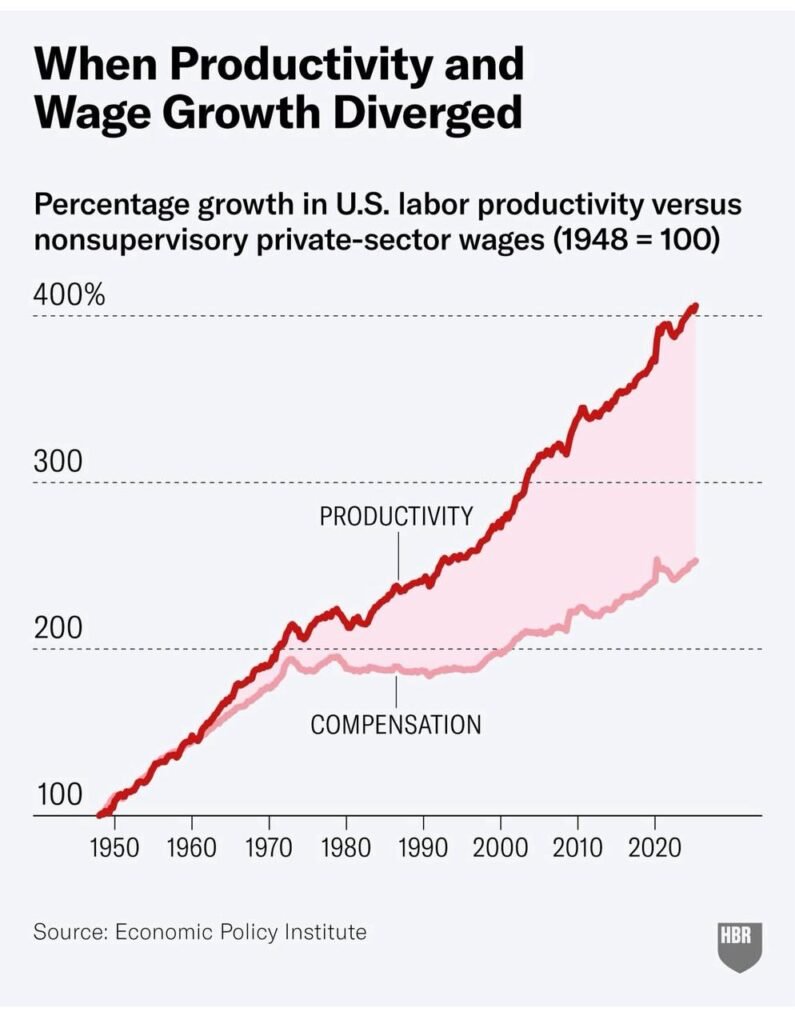

1. When Productivity and Wages Parted Ways

The Economic Policy Institute captures a defining economic shift of the modern era: since the late 1970s, U.S. labor productivity has continued to climb — nearly 400% higher than in 1948 — while workers’ real compensation has stagnated.

In the postwar decades, productivity and wages rose together. When workers produced more, they earned more, and prosperity was broadly shared. But around the late 1970s, the link between productivity and pay snapped. Since then, corporate profits and executive compensation have soared, while average workers’ wages have barely kept up with inflation.

This divergence suggests that economic growth no longer guarantees shared prosperity. Technological advances, globalization, and weakened labor bargaining power have combined to shift the rewards of growth upward — to shareholders and top executives — rather than across the workforce.

2. Wealth Concentration and the Global Divide

The OECD Wealth Distribution Database presents another piece of striking evidence of imbalance. Across countries, the richest 10% own the majority of national wealth — often 60% or more — while the poorest half of households control only a small fraction.

Brazil and Russia show extreme concentration, but even advanced economies like the United States, France, and Germany exhibit sharp disparities. India and China, despite their rapid economic growth, show similar patterns — proof that rising GDP does not necessarily translate into rising equity.

This imbalance isn’t just an abstract number. It affects everything from housing affordability and political stability to intergenerational opportunity. Wealth inequality compounds over time, widening the gap between the “haves” and the “have-nots,” and undermining the social contract that underpins democratic capitalism.

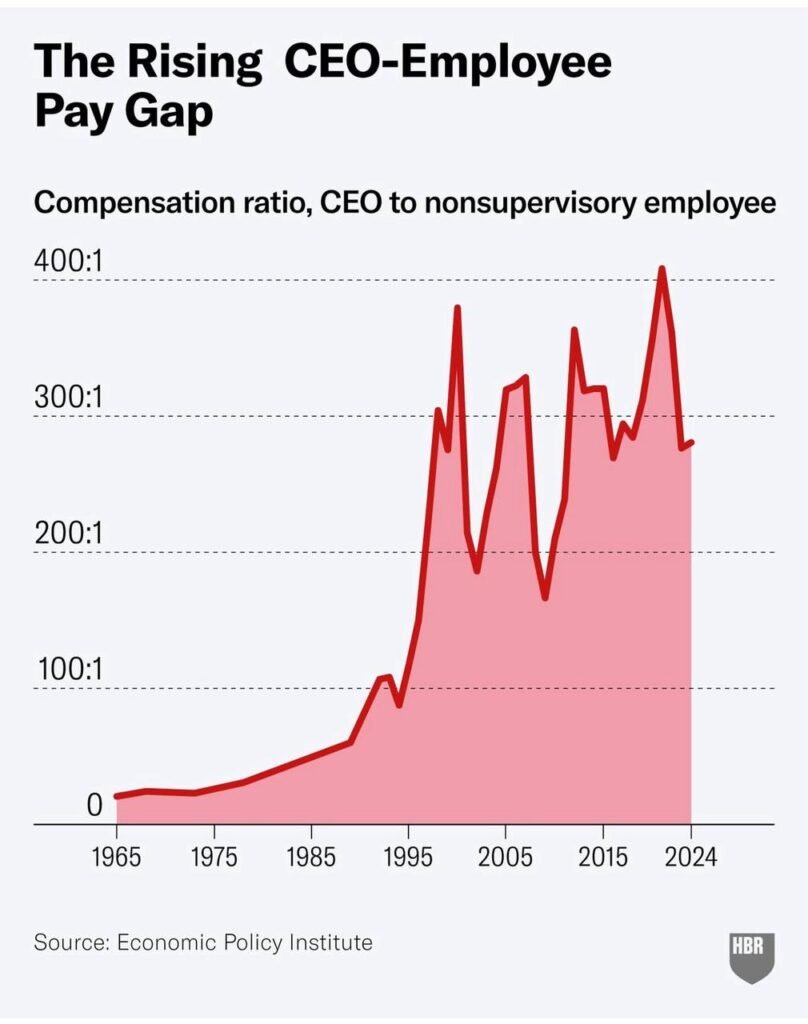

3. The Soaring CEO–Employee Pay Gap

Once again, the Economic Policy Institute drives the point home. Since the 1980s, the CEO-to-employee pay ratio in the U.S. has exploded — from around 20:1 in the mid-20th century to well over 300:1 today.

This isn’t a reflection of proportional productivity or skill — it’s the result of changing corporate norms, stock-based compensation, and boards rewarding executives for short-term shareholder value rather than long-term health.

The symbolism matters: when a CEO earns hundreds of times what the average worker does, it signals a deep cultural shift toward prioritizing capital over labor and prestige over shared contribution.

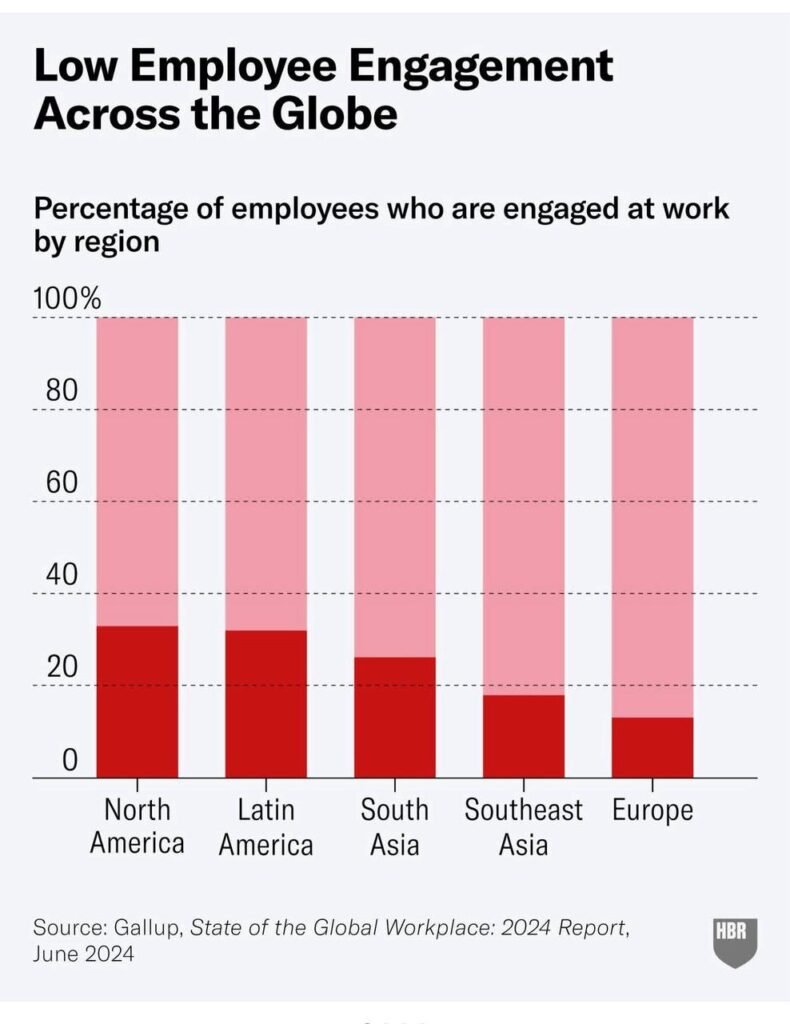

4. A Workforce Disengaged

Finally, Gallup’s 2024 “State of the Global Workplace” report reveals another consequence: low employee engagement across the globe.

Only about 20–25% of workers worldwide report being truly engaged at work. The rest feel disconnected, undervalued, or burned out. Europe shows the lowest engagement levels, but no region exceeds one-quarter of employees who feel actively motivated.

The connection is clear: when workers see little correlation between their effort and reward — when wealth and recognition concentrate at the top, and when purpose fades from work — engagement declines.

Low engagement isn’t just a human problem; it’s an economic one. Gallup estimates that disengaged employees cost the global economy trillions of dollars annually in lost productivity.

5. The Broader Story: Inequality as an Economic Risk

Taken together, these data tell a single story: productivity gains have been decoupled from human prosperity. Economic systems increasingly reward capital ownership and executive decision-making rather than the collective labor that drives output.

This imbalance threatens not just fairness but stability. When wages stagnate and engagement falls, consumer demand weakens, innovation slows, and trust in institutions erodes. The rise of populism and social unrest across nations is not an accident — it’s a symptom of this deeper economic design flaw.

6. Redefining What It Means to Be a CEO

Reversing these trends requires more than just policy reform — it calls for a redefinition of leadership itself.

The role of a CEO should extend beyond maximizing shareholder value. True leadership means serving employees, creating environments where people can work, grow, and thrive. It also means contributing to the broader society that makes business success possible.

Leaders can do this in many ways — from community investment and employee development programs to mentoring students and young professionals. Sharing knowledge, fostering inclusion, and supporting education are ways CEOs can give back to the ecosystems that sustain their companies.

The goal isn’t to punish success — it’s to rebuild a system where success is shared.

Final Thoughts

These data don’t just depict numbers — they reveal the slow unraveling of the postwar promise: that hard work and productivity would lead to prosperity.

To renew that promise, we must realign our economies around the idea that growth only matters when it lifts everyone. Progress should not be measured solely by corporate profits or GDP, but by how much it contributes to the success, dignity, and opportunity of all.

Because in the end, the strength of any economy depends not only on how much it produces — but on how fairly it shares what it creates.

#Leadership, #HarvardBusinessReview, #HBR, #FutureOfWork, #CEOs, #WealthInequality, #EconomicGrowth, #RedefiningLeadership, #InclusiveGrowth, #BusinessInsights, #WorkplaceCulture, #ManagementInnovation, #Productivity, #EmployeeEngagement